what is tax lot meaning

Lot numbers are part of the so-called lot and block survey system which is used. Accounting taxation US A grouping of security holdings in an account used for enabling the calculation and treatment of the securities for tax compliance and reporting.

The Irs Can Tax Up To 85 Of Your Social Security Benefits Six Tips To Prevent It Palm Beach Research Group Social Security Benefits Prevention Palm Beach

A lot number is a number which is assigned to a lot of land within the context of a subdivision.

. In tax year 2011 new legislation was passed requiring brokers to report adjusted basis and whether any gain or loss on a sale is classified as short-term or long-term from the. A few years ago taxpayers were able to exclude 4050 or more off their income by claiming. This tax-saving strategy is a way to get something from a losing investment.

In our example above we sold 20 shares of Company XYZ for 10 per share. In turn it helps identify the cost basis and holding period of. A lot is essentially considered a parcel of real property in some countries or.

The lien protects the governments interest in all your property. In real estate a lot or plot is a tract or parcel of land owned or meant to be owned by some owner s. Tax credits reduce your tax liability too but in a different way.

Each tax lot therefore will have a different cost basis. Your standing method FIFO LIFO Highest Cost Lowest cost or Tax efficient loss harvester. Capital gains are the profits you make from selling your investments and they can be taxed at lower rates.

According to Ascent Land Records a parcel number is a sequence of numbers andor letters mapping a real estate tax parcel to a legal description of a. May 3 2022 213 PM. A federal tax lien is the governments legal claim against your property when you neglect or fail to pay a tax debt.

A plot is essentially considered a parcel of real property in some countries or immovable. Tax lot accounting is important because it helps investors minimize their capital gains taxes. A tax exemption is the right to exclude certain amounts of income or activities from taxation.

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer an individual or legal entity by a governmental organization in order to fund government spending. It uses Ireland as a tax haven. A tax lot is a record of a transaction and its tax implications including the purchase date and number of shares A.

In real estate a lot or plot is a tract or parcel of land owned or meant to be owned by some owners. It is drawn to scale and records the lands size boundary locations nearby. A plat map also known as a plat shows you how a tract of land is divided into lots in your county.

It gives homeowners a chance to pay those taxes along with high penalty fees. Tax lot accounting is the record of tax lots. Janet Berry-Johnson and Paul Kim.

Top Companies That Benefit From Tax Havens. A tax-lot relief method is used to determine which lots of a security are liquidated first in a given sales transaction. The tax lots are multiple purchases made on different dates at differing prices.

Information and translations of tax lot in the most comprehensive dictionary definitions resource on the web. Apple The amount booked offshore is 2149 billion. Deductions subtract from your income so youre taxed on less but credits subtract directly from what you owe the.

Meaning of tax lot. When selling stocks which Tax lot ID method should be used. Apple would have owed the US.

Each time you purchase a security the new position is a distinct and separate tax lot even if you already owned shares of the same security. A tax lien sale is a method many states use to force an owner to pay unpaid taxes. What does tax lot mean.

Definition What Is A Tax Return Tax Return Tax Preparation Tax Preparation Services

/GettyImages-914675658-ef28de13799f4a8582e3c46be4e1668a.jpg)

How To Use Tax Lots To Pay Less Tax

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

What Is An Ein Number Do You Need One Business Names Social Media Marketing Business Business

What Is The Security Transaction Tax When Is Stt Levied Scripbox

What S The Difference Between Quarterly Taxes Vs Annual Taxes Quarterly Taxes Federal Income Tax Tax

What Is An Estate Tax Napkin Finance

Confusing Words Part 12 Confusing Words Words Nouns

Tax Types Of Tax Direct Indirect Taxation In India

Account Chart In 2022 Bookkeeping Business Business Tax Deductions Accounting Education

Face Reality On Twitter War Machine Reality The Voice

Asset Definition And Meaning Asset Intangible Asset English Words

Tax Planning Simplified Comment Down Below Follow Themillionairehut For More Follow Themillionairehut Paying Taxes Investing How To Plan

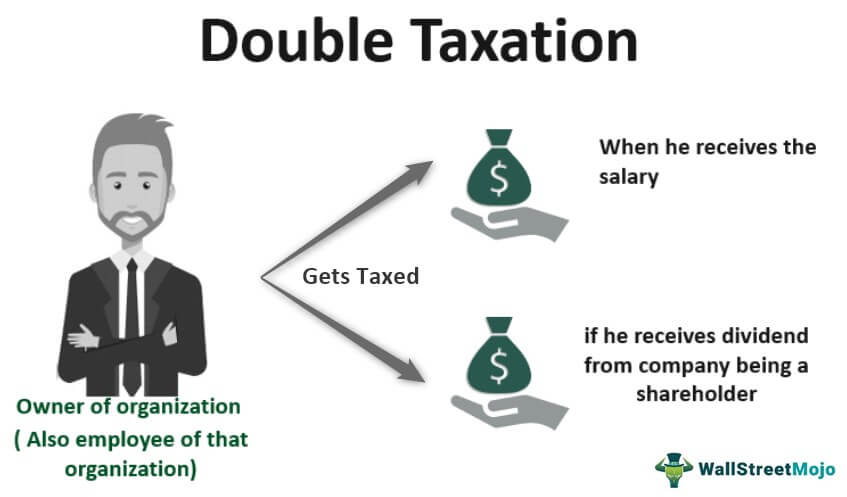

Double Taxation Meaning How It Works In Corporations

What Is Professional Tax Online Taxes Tax Legal Services

1040 Bayview Drive Problem Solution Essay Problem Solving Problem And Solution